Press Release

CONGRESSMAN CUELLAR BACKS BIPARTISAN ECONOMIC STIMULUS PLANLegislation Will Offer Tax Rebates for 8,600,000 Families in Texas

Washington,

January 29, 2008

|

Yolanda C. Urrabazo

((202) 225-1640)

Tags:

Tax Relief

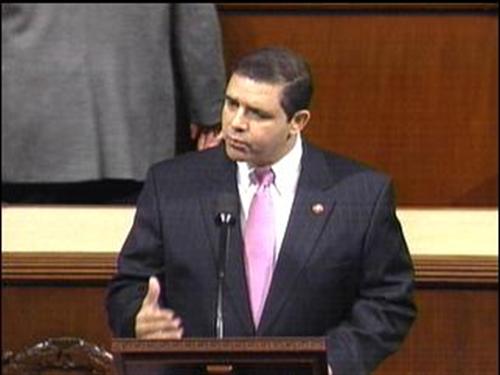

Congressman Cuellar today joined an overwhelming bipartisan majority in the House of Representatives in support of the Recovery Rebates and Economic Stimulus for the American People Act. The legislation will help stimulate the economy, providing tax rebates to 8,600,000 households in Texas and was passed by a vote of 385-35. Congress is determined to act quickly, so that families could receive tax rebates of up to $1,200 per couple, plus $300 per child, as early as mid-May. “Families in the 28th Congressional District are facing economic struggles, and Congress has responded,” said Cuellar. “I’m proud Democrats, Republicans and the Bush Administration worked together to craft a plan that will give the economy a much-needed boost, and deliver to lower- and middle-income families and seniors the relief they need right now.” “In my district, the median household income is $36,000, and these families face rising prices in utilities, food, and health insurance, which stretch their monthly budgets to nearly the breaking point,” Cuellar said. “Nearly 39% of these households are headed by single mothers living below the poverty level, who struggle to feed and clothe their children with the limited budgets they have as the sole earner.” The bill passed today provides a recovery rebate to 117 million families, including 13 million senior citizens and 35 million families who work but make too little to pay income taxes. The broad-based stimulus package will provide tax relief of up to $600 per individual and $1,200 per married couple, plus an additional $300 per child. All told, the bill is estimated to provide an average tax rebate of $907 to Texas families, save them a total of $7.8 billion across the state, and create new jobs. “As a member of the Small Business Committee, I am pleased to see that the legislation also includes tax cuts for small businesses throughout my District,” said Cuellar. The plan doubles the amount small businesses can immediately write off their taxes for capital investments, and encourages investments in new equipment. Additionally, the plan offers immediate tax relief for all businesses to invest in new plants and equipment by speeding up depreciation provisions, so that firms can write off an additional 50 percent for investments purchased in 2008. “Small businesses are the driving force behind our economy,” added Cuellar. “Our bipartisan bill gives these businesses incentive to expand their operations, hire new workers and help our economy get back on track.” Importantly, the bipartisan plan also includes provisions to help families avoid losing their homes to foreclosure. The bill expands affordable mortgage loan opportunities for families at risk of foreclosure through the Federal Housing Administration. To enhance credit availability in the mortgage market, the measure also includes a one-year increase in the loan limits for single family homes from Fannie Mae and Freddie Mac. ###

Congressman Henry Cuellar is a member of the House Homeland Security, Small Business, and Agriculture Committees in the 110th Congress; accessibility to constituents, education, health care, economic development and national security are his priorities. Congressman Cuellar is also a Senior Whip. |